OIL AND JAPAN

Oil storage tanks

Japan is the third largess oil consumer after the United States and China. It relies on oil for about half of its energy needs. Oil consumption in 2002: 1. 935 billion barrels, compared to 7.2 billion barrels in the United States.

Japan has dozens of large oil storage tanks for a strategic oil reserves that could keep Japan going if imports were suddenly to dry up. It has stockpiles of 570 million barrels enough to last for 172 days.

The demand for petroleum products in projected to fall by 16 percent between 2010 and 2015 as result of aging population, declining population and environmental awareness.

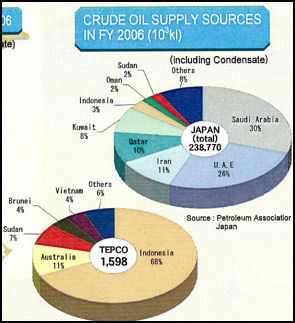

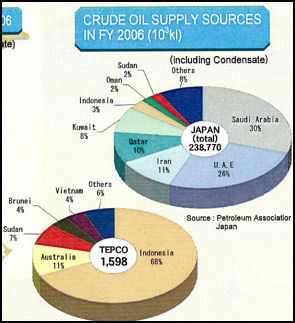

Sources of Oil for Japan

kerosene vending machine

Japan is the world's second largest importer of foreign oil. Japan uses about 4.5 million barrels of oil a day, and 99.7 percent of Japan's oil is imported. Much of the oil industry is controlled by the state-owned Japan National Oil Corp.

As 2004, Japan got 90 percent of its oil from the Middle East, compared with 86 percent in 2003 and 70 percent in 1991. Japan pays $1.50 a barrel for shipping costs from the Middle East. About 80 percent of Japan’s oil exports pass through the Straits of Malacca.

Sources of oil in 2006: 1) Saudi Arabia (31.1 percent); 2) United Arab Emirates (25.4 percent); 3) (Qatar 10.2 percent); 4) Iran (11.5 percent); 5) Kuwait (8.2 percent); 6) Indonesia (2.8 percent); 7) Sudan (2.9 percent); 8) Oman (1.5 percent); 9) Iraq (1 percent); Other (4.8 percent).

Japan gets much of its oil from Saudi Arabia and the United Arab Emirates. In Japan, there are worries that UAE will give preferential treatment to China. In December 2007, Japan said it would lend $3 billion to debt-ridden Abu Dhabi as part its effort to secure a reliable supply of oil.

In 2004, Saudi Arabia promised to supply Japan and South Korea with oil no what the situation was on the world market. In return Saudi Arabia wants help from Japan and South Korea developing infrastructure in Saudi Arabia.

Japan also gets large amounts from oil and natural gas Indonesia and Malaysia and hopes to increase it supplies from Russia and Central Asia. Japan’s effort to secure oil supplies overseas has experienced a number of set backs. The has been problems with the Sakhalin 2 project in Russia, the Azadegan oil fields in Iran and the Kashagan oil field in Kazakhstan,

Oil, See Terrorism

Oil Companies in Japan

In December 2008, Nippon Oil, Japan’s largest oil distributer, announced it world merge with the Nippon Mining to form the world’s 8th largest oil company and the 4th largest company in Japan. The new company will have $130 billion in combined sales and a 33 percent share of gasoline sales in Japan, double its nearest rival, Exxon-Mobile. Nippon Oil was created by the merger of Mitsubishi Oil and Nippon Oil in 1999. It operates 10,000 Eon gas stations and has 12,700 employees. Nippon Mining operated 3,500 Jomo gas stations and has 10,000 employees.

Impex Corp. is Japan’s largest oil exploration company. It is 29 percent owned by the government and has annual sales of around $10 billion to $20 billion.

In October 2010, ExxonMobile announced it was pulling out Japan . It had been considering the move since 2005 because of declining demand for gasoline and light oil as a result of increased energy efficiency and use of fuel-stingy cars, . The company operated gas stations in Japan under names Esso, Mobile and General. These were sold on an area by area basis. There is a good chance that refining operations will also be sold in the future.

Oil Refineries in Japan

Japan has large refining capacity. It exports light diesel oil to China, Taiwan and Singapore and kerosene to the United States.

JX Holding is Japan’s largest oil company. It has refining capacity of 1.8 million barrels a day, as of 2008. It reduced its output to 1.4 million barrels a day in 2010. It has 8 refiners, at one time they reached 90 percent of capacity. As of 2010 they were operating at around 70 percent of capacity.

As gasoline consumption has declines, Japan has had to reduce it refining capacity as demand falls and is stuck with a glut of gas stations.

Three major Japanese oil refiners posted huge extraordinary losses in fiscal 2010-2011 due to damage to refineries and other facilities caused by the March 11 earthquake and tsunami. JX Holdings Inc lost ¥ 126 billion due to damage to its refineries in disaster-hit Sendai in Miyagi Prefecture and Kamisu in Ibaraki Prefecture. Idemitsu Kosan lost ¥ 5.3 billion due to damage to its oil tank in Shiogama in Miyagi Prefecture, while Cosmo Oil Co lost ¥5.7 billion due to damage to its refinery in Ichihara, Chiba Prefecture. [Source: Kyodo, May 13, 2011]

However, Idemitsu and Cosmo logged increased group sales owing to strong sales of gasoline and kerosene due to hot spells in summer and severe cold in winter. Idemitsu’s group net profit jumped 915 percent from the previous year to ¥60.68 billion, aided by improved margins on oil products. In its first earnings report for a whole business year, JX Holdings, created through the management integration of Nippon Oil Corp and Nippon Mining Holdings Inc in April 2010, said it posted a group net profit of ¥311.74 billion yen sales of 9.63 trillion yen. [Ibid]

Around the same time JX Holding, Japan’s largest oil company, said it mulling closing its Negishi Refinery, one of the largest such facilities in Japan with a capacity of 270,000 barrels. It too cited shrinking future demand.

Thermal plant

Natural Gas and Japan

Japan is the world’s largest importer and consumer of natural gas, importing 97 percent of its supplies. Natural gas is used to fuel power plants and in home for cooking and heating. Japan wants to shift even more from oil to natural gas, increasing the percentage natural gas of total energy consumption from 13 percent to 23 percent (2002). The price of natural gas in Japan is more double the price in Europe and almost four times that of the United States.

Japan is the world’s largest importer of LNG. It has about a 100 LNG power plants. There are LNG facilities around Tokyo Bay, Osaka Bay, Kitakyushu and other places. Some worry about the catastrophic impact of an LNG tanker explosion. Sometimes LNG tankers pass very close to densely populated areas and heavily industrialized areas.

Japan gets between 20 percent and 40 percent of its LNG from Indonesia. It wants to strike a deal with Indonesia to ensure the supply is stable. Starting in 2011, Indonesia plans to reduce export to Japan to less than one forth of current levels to meet increased domestic demand.

Qatar has abundant natural gas reserves but is notorious for trying to make as much money as it can from its gas. Supplies from Sakhalin, Russia are delayed from 2008 to spring of 2009 and those from Gorgon, Australia may but not arrive until 2012. Japan is helping to develop gas fields in Britain, Iran Vietnam and elsewhere in Southeast Asia.

Osaka gas has developed a portable device that can transform natural gas extracted from offshore oil wells into naphtha liquid fuel and hopes to begin sales of the device around 2015. Transforming natural gas into naphtha cuts greenhouse emissions and helps companies make money from gas they would normally burn off. Natural gas extracted from land-based oil wells is typically transported by pipelines and then used. On offshore there usually is no alternative but to burn it off.

Big LNG Tanks and Tankers: Japan Uses More Natural Gas After the Fukushima Crisis

LPG ship

Japan's LNG imports began rising at a record pace in 2011 as utilities ramp up gas-fired power generation to offset a near-record low in nuclear plant utilisation in the wake of the Fukushima radiation crisis.

In August 2011, Reuters and Kyodo reported: Osaka Gas Co , Japan's second-biggest city gas distributor, said it would build one of the world’s largest liquefied natural gas (LNG) tanks at its Senboku LNG terminal 1 to meet rising demand for natural gas. The company aims to start construction of the tank with capacity of 230,000 cubic meters in September 2012 and complete it in November 2015. It will cots between ¥10 billion and ¥20 billion.

The tank will 60 meters high and have an external diameter of 90 meters, making it almost as long as a football field, and will be able to store the annual consumption of 330,000 households. Terminal 1 handled 1.1 million tonnes of LNG in the year ended in March, the company said in a statement.

In August 2011, Kyodo reported, Tokyo Gas Co. unveiled its new liquefied natural gas tanker, one of the world's largest. The 300-meter-long, 143,000-ton Energy Horizon, currently berthed near an LNG plant in Chiba Prefecture, can transport around 80,000 tons of LNG in its spherical tanks, enough to meet annual gas demand from some 270,000 households, the firm said. The new ship, co-owned by a Tokyo Gas subsidiary and major shipping firm Nippon Yusen K.K., will travel mainly between Japan and Australia. [Source: Kyodo, August 25, 2011]

Tokyo Gas intends to expand its LNG business because utilities are expected to step up thermal power generation in the face of the nuclear crisis, which has left numerous reactors shut down. Tokyo Gas imported 10 million tons of LNG out of a total 70 million tons shipped to Japan in 2010.

Major companies such as Mitsubishi Corp., Tokyo Gas Co. and Osaka Gas Co. are studying the prospect of building a large liquefied natural gas plant on the Pacific coast of Canada to tap shale gas are aimed at ensuring a stable supply of natural gas, global demand for which is rising sharply. As part of its effort to reduce its dependence on nuclear-based electric power, shale gas is increasingly looking like a good alternative especially with North America being a major source rather than areas with high geopolitical risk, such as the Middle East and Russia.

Natural Gas in Waters Between Japan and China

Osaka Gas imports

There are large undersea natural gas fields in waters claimed by both China and Japan in the East China Sea about halfway between Okinawa and the Chinese mainland. The Chunxiao and Tianwaitian natural gas fields lie in China’s exclusive economic zone. The Chunxiao field covers 8,500 square miles and holds up to 9 trillion cubic feet of gas, enough to meet China’s needs for seven years.

The area is near a group of disputed islands claimed by Japan and China known as the Senkaku to the Japanese, Diaoyu to the Chinese and Tiaoyutai to the Taiwanese. The actual line of demarcation of the boundary of the exclusive economic zones (EEZ) between China and Japan is a matter of dispute. Japan wants to make a deal but China seems more intent and trying to get away with as much as it can without actually violating international law. China so far has drilled only waters in its EEZ but it has angered Japan because these areas are so close to the disputed border.

According to the United Nations Convention on the Law of the Sea each coastal nation controls a an economic coastal zone that extends 200 nautical miles (230 miles, 375 kilometers) from the shoreline. The distance between Okinawa ad China is about 400 miles. Japan advocated a median line between the two countries. China advocates setting its economic border on the eastern extension of the continental shelf, a concept that pushed the border 50 miles of f the Okinawa archipelago. It seems unlike the two countries will ever agree on the line.

An area of 400 square kilometers, or 150 square miles, lies at the heart of the dispute. Japan has suggested that Japan and China tap the gas fields together. Thus far China has rejected these offers. Japan has also demanded that China make pubic its survey and drilling results because two of the three major gas fields that China found are believed to extend into territory claimed by Japan. Beijing has reportedly awarded exploration right to Chinese companies to explore blocks that extend into Japan’s EEZ.

Four main natural gas fields from north to south (Chinese name in parentheses): 1) Asunaro (Longjing); 2) Kusunoki (Duanqiao); 3) Kashi (Tianwaitian), closest to the Chinese mainland; 4) Shirakaba (Chunxiao)

Drilling for Natural Gas in Waters Between Japan and China

Senkaku islands

In June 2004, China began developing the Chunxiao site. It is now aggressively drilling at Chunxiao and Tianwaitian while Japan has yet go beyond doing geological surveys partly because the most promising areas for oil and gas are in disputed areas. China has gas production platforms less than a mile west of waters claimed by Japan. Japan claims that this platform is sucking gas from a deposit that extends over Japan’s side of the line.

In 2004, China began laying 291-mile gas pipeline between Shanghai to Chunxiao. Ironically $120 million for the $1 billion project came from Japanese ad.

Japan has earmarked $125 million to search for oil I the disputed area. In March 2005, the Japanese hired a Norwegian seismic ship to do surveys for oil and gas, While it was doing so it was treated as a spy ship by the Chinese and followed by Chinese ships. Japan is spending $100 million for its own seismic ship.

In 2005, the Japanese government awarded the Japanese company Teikoku Oil right to drill for oil at three sites near the “median line” that Japan says divide the Japan’s and China’s EEZ. In July 2005, China called Japan’s plan for drilling “a violation.”

In September 2005, Japan urged China to stop developing the disputed gas fields and called for joint exploration. In March 2006, China proposed that Japan and China jointly explore for oil and gas at one site the East China Sea together. Japan rejected the proposal. The site proposed by China is thought to be one that doesn’t contain much oil or gas. The disputed areas where gas has been found were not part of the proposal. Japan repeated its suggestion that the disputed areas should be jointly developed.

In October 2006, Chinese President Hu and Japanese Prime Minister Abe agreed to aim to resolve the dispute early with some of joint development. And promised to make the East China Sea a “sea of peace, cooperation and friendship.”

China began production at the Chunxiao field in the first half of 2006. An official with CNOOC said China intends to “launch normal production operations on its own territory.” According to a CNOOC year end report for 2006 listed on its website production at Tianwaitian field was 113,267 cubic meters of natural gas a day and 42 barrels of oil a day. Production is believed to be much higher than that. No production figures were given for the Chunxiao, Canxue and Duanqiao fields.

Natural Gas Deal Between Japan and China

In 2008, China and Japan agreed to share the development of the Shirakaba and Asunaro gas fields. The agreement to develop the Shirakaba field was announced during a visit by Chinese President Hu Jintao to Japan.

Japan has offered to provide much of the funding for joint development of natural gas deposits in the East China Sea. China is reluctant to a agree to joint development because it feels that such an agreement would invalidate China’s claim on the entire continental shelf.

In June 2008, Japan and China reached an accord on developing the natural gas fields in the East China Sea, with Japan investing in a gas field already operated by China (the Chunxiao field) and the two nations jointly exploring an area not yet developed (the Asunaro gas field, which China calls the Longjing field). An agreement was not made on the Asunaro field, in part because of South Korean claims in the area.

After the agreement was made Japan discovered that China was developing a natural gas field known as Tiawaitan to the Chinese and Kashi to the Japanese and lodged a complaint saying development of the site went against the sprit of the agreement. China responded by saying that it had the right to drill at the site.

Japanese Energy Sources Abroad

crude oil suppliers

The State-owned Japanese oil companies Impex Corporation and Japan Petroleum Exploration (Japex) Company are the two large oil exploration companies in Japan. Japex is surveying for oil in Iraq and has invested in oil sand projects in Canada.

Impex is the successor of the Japan National Oil Corporation, which has an almost unrivaled history of failure. During its 38 years of existence it engaged in 305 projects around the world, most of them yielding nothing. When it disbanded it was $7 billion in debt.

Japanese companies are involved in exploring for and producing oil and natural gas in the Middle East. Japan lost the right to pump oil from a neutral zone between Kuwait and Saudi Arabia. The Tokyo-based Arabian Oil Co. had rights to drill in the Kafji oil field in Saudi Arabia until the plug was pulled on the project because Saudi Arabia wanted Japan to build a mineral-carrying railroad but Japan couldn't afford to.

Japan has aggressively set up join ventures in Texas and other places to take advantage of new technologies to extract natural gas from shale.

The trading houses Mitsubishi and Mitsui are involved in a number of energy projects including one to develop natural gas deposits above the Arctic Circle on the Yamal Peninsula in northwestern Siberia. By some estimates 30 percent of the world’s natural gas reserves lie in the Arctic.

In February 2010, INPEX announced that had acquired development rights of part of the Orinoco oil field in eastern Venezuela.

Iraqi and Iranian Oil and Gas and Japan

leaders of Japan and Iran

Japan has a $5 billion deal with Iran and Qatar to search for and develop natural sites in the Persian Gulf. The sites are the Iranian-owned Pars South and adjacent Qatar-owned North Field, the largest and second largest gas fields in the world. Pars has 13 million cubic meters. North Field has 9.8 trillion cubic meters.

Japanese efforts in Iran are hampered by U.S. restrictions on doing business there. In March 2006, the United States asked Japan to suspend its plans to develop Iran’s promising Azadegan field partly to support the United States efforts to isolate Iran on the nuclear weapons issue.

The Osaka-based Tomen Company has a $2.5 billion deal with Iran to develop a large oil field that could provide Japan with 300,000 barrels of oil a day for two decades. Some think China might take advantage of the situation and take Japan’s

Japan has had problems developing the Azadegan oil field in Iran. In October 2006, Inpex, which is partly owned by the Japanese government, announced t was going to reduce its share in the Azadegan project from 75 percent to 20 percent.

Stakes in Iranian fields that Japanese oil companies gave up because of political pressure from the United States have been snatched up Chinese oil companies.

Several Japanese companies have contracts to develop oil fields in Iraq. Japan Petroleum Exploration and Malaysian Oil Company are working with South Oil, an Iraqi government firm, to develop a field in Garraf in southern Iraq.

In June 2009 it was announced that Nippon Oil Corp. Was expected to be given the rights to develop part of the Nassiriyah oil field in southern Iraq. The plots are expected to yield 600,000 barrels of oil a day—about 10 percent of what Japan consumes each day—two years after development begins. If the deal goes through it will be the largest field developed independently by a Japanese company. Before the largest field developed was in the Khafji oil field in the Persian Gulf. Nippon Oil will develop Nassiriyah with JGS, an oil exploration company, as part of a $100 billion project that also includes construction of an oil refinery and power plant.

Russian Oil and Gas and Japan

Japan is looking to Russia for the future for its energy needs. Oil rigs near Japan could supply Japan with 250,000 barrels of oil a day. There are also large deposits in Siberia that could be directed towards Japan. There are also concerns. Russia has been aggressive and uncompromising in sales of gas to Europe.

A number of Japanese energy are involved in projects in Siberia and Far East Russia. Japan Oil, Gas and Metals National Corporation (JOGMEC) is conducting feasability studies in eastern Siberian oil fields, Itochu, Marubeni, Mitsui, Mitsubishi and other are involved with Sakhalin 1 and 2. Japanese companies are sought for their expertise and money. Having them and the Japanese government involved in these projects is viewed by the Russians and others involved as a way of reducing risk and having a reliable market for its oil.

The first shipment of Sakhalin-2 gas arrived in Japan in April 2009. It takes three to four days to ship LNG from Sakhalin, considerably less time than from the Middle East.

About 60 percent of the gas from Sakhalin 2 is earmarked for Japan with the remainder going to te United States and South Korea. Sakhalin 2 gas will account for 7 percent of Japan’s annual gas imports an reduce its dependance on the Middle East for energy. The plan is to sell Japan five million tons of liquified gas a year for 24 years, starting in 2009.

Mobile Exxon is the leading investor in the Sakhalin project. It own 30 percent. Japanese companies own 30 percent in part ensure that gas from the project ends up in Japan. There are an estimate reserves of 485 billion cubic meters in the Exxon Mobile project, enough to supply Japan’s gas needs for six years.

Japan also wants to get some more of Russia’s Siberian oil. The shipping cost for Russian oil is about a third of the $1.50 a barrel it spends for shipping Middle East oil. Mitsui is negotiating with Gazprom to develop some of the worlds largest gas fields in eastern Siberia and the Barents Sea.

There are hopes that a deal over oil and gas between Russian and Japan might also lead the countries to a settlement over the Kurile Island dispute which has hampered relationships between the countries since the end of World War II.

In March 2008, Japan’s Natural Resources and Energy Agency made an agreement Rosneft, the Russian state-run oil company, to developed fields on Sakhalin island and eastern Siberia. Mitsubishi and Mitsui companies are likely to get stakes to the Sakhalin 3 site, which is believed to have the largest oil and gas reserve of the three Sakhalin sites.

LNG from Sakhalin is transported in huge tankers with large tanks collectively able to carry 65,000 tons of LNG. The trip from Sakhalin to Tokyo Bay takes about a week.

Pipeline from Siberia to Japan

There are plans to build a 2,500-mile (4,150-kilometer) pipeline—the world’s longest—between Angrask and Taychet near Lake Baikal in eastern Siberia to the Vostochny, near the Russian port of Nakhodka on the Japan Sea, where oil would shipped by tanker to Japan. The pipeline will be the longest and most expensive ever built. If built it t would be three times longer the trans-Alaska pipeline and carry 1 million barrels a day through its 1.2 meter (four foot) in diameter pipe and increase Russia’s oil-carrying capacity by a third. It could take a decade to complete.

The pipeline is expected to cost around $12 billion and has been described as the biggest project in Russia since the Trans-Siberian Railroad. The pipeline was originally supposed to cost only $6 billion but high steel prices, environmental concerns and problems presented by permafrost have pushed up the price. Japan is expected to shoulder 80 percent of the costs and get most of the oil, although a lot will be sold on the open market to any country.

In December 2004, it was decided to switch the terminus of the pipeline from the industrial port of Vostochny to Perevoznaya, a tranquil bay known its wildlife and beaches. It is a popular retreat for people from Vladivostok. The pipeline could go through areas inhabited by rare Amur leopards. Tankers would steam through Russia’s only maritime park, a cluster of islands home to 3,000 species of birds. Environmental groups strongly oppose the plan

Work on the pipeline was due to begin in 2005, with the first section from Tayshet to Skovorodino. Near the Chinese border, to be completed by 2008. Work however was suspended in 2005 due to ecological concerns. Among them was the fate of the Amur leopard, whose territory would be bisected by the pipeline, and Lake Baikal. Work was ordered halted within 1.6 kilometers of Lake Baikal..

There are still many doubts about the project: foremost among them is whether or not there is enough oil in the Siberian fields to justify such an expensive project.

As of May 2010, the pipeline between the East Siberian oil field to Vladivostok was about half done.

Pipeline from Sakhalin to Japan

There are plans to build a 930-mile undersea pipeline to move the gas from Sakhalin Island to Japan. The cost of the pipeline is estimated at $16 billion. Japan has not committed itself to the project. Japan needs the gas but not badly enough to justify paying such a high price. One of the main obstacles for Japan is that its fishermen wan tto be compensated for losses.

The Sakhalin pipeline will cross 24 major fault lines and more than 200 salmon-spawning rivers. The oil companies have proposes building bridges over seven of the salmon streams. Russian government experts want to see 29 bridge crossings. If the pipeline were to rupture in an earthquake it could cause serious ling term damage to these streams.

Competition Between Japan and China Over Russian Oil and Gas

Both China and Japan have been courting Russia for a pipeline that would bring oil from eastern Siberia to them. In the fall of 2004, the Russian government made it clear was going go through with pipeline that help Japan, who offered Russia $7 billion in financing for the pipeline and oil development projects. The Russians prefer this pipeline anyway over the one to China because oil could be sold to a number of buyers—Japan, South Korea, maybe the United States—whereas the other deal is to a single buyer—China—and gives them too much leverage over price. The Chinese were appeased with the promise that Russia would increase its exports to China by rail by 300,000 barrels a day.

There is one plan to build a branch pipeline off the pipeline from Angarsk to Nakhodka that would go to Daqing in China. The costs of the branch would be between $2.5 billion and $3 billion. This plan was given a major setback when Yukos president was jailed in June, 2003 and Japan provided Russia with lucrative financial considerations for an alternative pipeline through Siberia that bypassed China. The Japanese promised to spend $12 billion to cover construction cost and provide money for private companies for oil exploration.

China has had discussions with Exxon Mobile about buying gas from their fields off Sakhalin Island, which Japan assumed was going to go to them. Exxon Mobile is somewhat angry with Japan for not moving faster to building a pipeline from Sakhalin to Japan. Disruptions on the Sakhalin projects and promises by Exxon to give China gas from Sakhalin 1 may mean that Japan gets less natural gas.

Coal and Japan

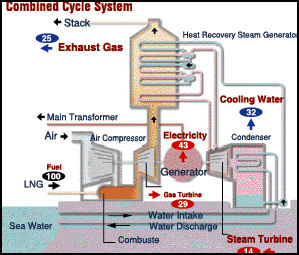

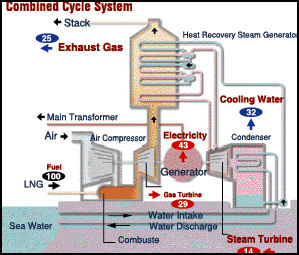

thermal combined system

During the 1950s, Japan relied on coal to fire its growing economy. In 1960, Japan's 600 coal mines produced 55 million tons of coal a year. Over the years companies switched to oil and imported coal. By 1979 there were only 102 coal mines left, and by 1985 only 11.

Coal accounts for 23 percent of Japan’s energy consumption. Despite also its claims to be a green society and at the forefront of saving energy and reducing greenhouse gas emissions Japan burned twice as much coal in 2008 as it did in 1998.

Japan (198 million tons) and South Korea (98 million tons) are the largest coal importers. Japan gets 63 percent of its coal from Australia. It also gets a lot of coal from Vietnam.

Japan is a leader in producing energy-efficient, coal-power technology. With global demand for coal power expected to remain high in years to come—and with that demand for low-emission and high efficiency coal power generation also expected to remain high— producers of cutting-edge coal power generation are increasingly looking abroad for sales. Hitachi and Toshiba are finding markets for steam turbines in China and India and other countries, Electric Power Development Co., better known as J-Power, is building power plants in China.

Japan is a leader in clean coal technology such as IGCC (integrated gasification combined cycle), in which coal is turned into gas to remove impurities before combustion; and IGFC (integrated gasification fuel combined cycle), in which gasified coal achieves high power generation efficiency with a triple system of fuel cells. gas turbines and steam turbine. These systems are still largely experiential at this stage yet Japan is introducing the technology to China, India and other countries.

Coal Supplies and Japan

Japan effectively terminated its domestic coal production in 1990 as the high value of the yen made it much cheaper to import coal. The last coal mine, the Taiheiyo Tanko coal mine in Kushiro, Hokkaido, closed in January 2002. Located 800 meters offshore and 700 meters under the sea, it was a state-of-the-art facility that produced coal at about three times the world price. The mine couldn't compete with cheap import coal, and nationwide power plants were switching from coal to cleaner oil and natural gas. The mine closed when its $1 billion a year government subsidies were cut off.

Japan imports 99 percent of its coal. Most of Japan’s coal is imported from Australia, Canada, China and Vietnam. The amount that Japan imports is roughly equal to a forth of all the coal traded internationally. Because Japan imports many kinds of coal from man different sources it very good at evaluating the energy efficiency of different kinds of coal.

Australia is Japan’s largest coal supplier, supplying it with 179.16 million tons of coal a year. This amounts 59 percent of Japan’s coal imports, which is more or less the same thing as Japan’s coal consumption since Japan doesn’t produce any coal of its own any more.

An upsurge in energy prices that has spread to coal (the price of coking coal imported to Japan from Australia jumped from $100 a ton to $300 a ton between 2006 and 2007) spurred Japanese coal companies to reopen mines. Hokkaido Electric Power Company doubled its coal order in 2008 from Hokkaido mines from 500,000 to 1 million tons.

Image Sources: 1) Jun from Goods in Japan 2) 3) Japan Nuclear Power Program 4) 5) 10) 13) 14) TEPCO 6) Doug Mann Photomann, 7) 8) Osaka Gas, 11) Office of Prime Minister of Japan, 12)

Text Sources: New York Times, Washington Post, Los Angeles Times, Daily Yomiuri, Times of London, Japan National Tourist Organization (JNTO), National Geographic, The New Yorker, Time, Newsweek, Reuters, AP, Lonely Planet Guides, Compton’s Encyclopedia and various books and other publications.

Japan is the third largess oil consumer after the United States and China. It relies on oil for about half of its energy needs. Oil consumption in 2002: 1. 935 billion barrels, compared to 7.2 billion barrels in the United States.

Japan is the third largess oil consumer after the United States and China. It relies on oil for about half of its energy needs. Oil consumption in 2002: 1. 935 billion barrels, compared to 7.2 billion barrels in the United States.